How Renters Insurance Protects You and Your Landlord

Renting a property in Windsor comes with responsibilities, not just for landlords, but also for tenants. One of the most important protections tenants can have is renters insurance in Windsor. At Richmond Property Management, we help landlords set expectations for coverage while guiding tenants to secure the right insurance to protect themselves and their belongings.

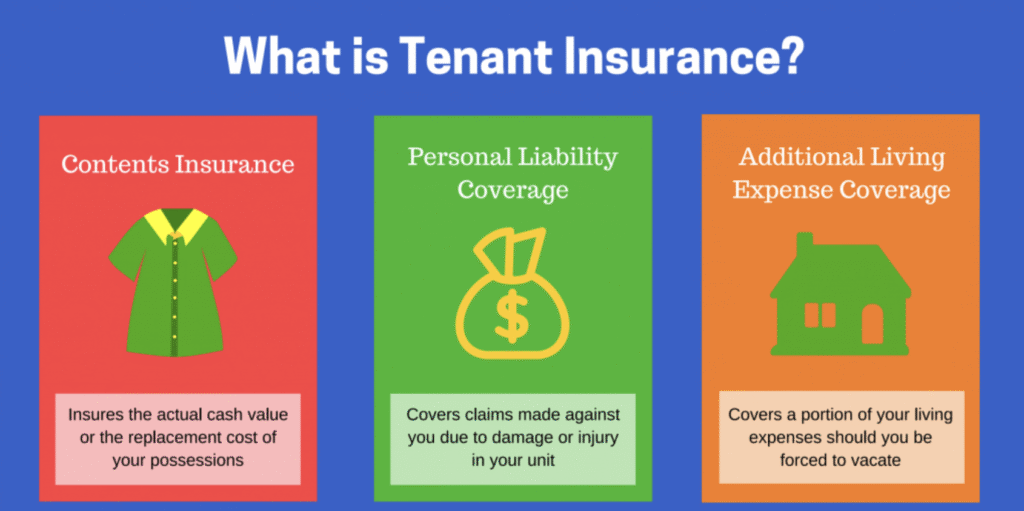

What Is Renters Insurance and Why It Matters

Renters insurance is a type of coverage that protects tenants’ personal property and provides liability protection for accidents that occur in a rental unit. For landlords, requiring tenants to have insurance reduces risk, ensures tenants are financially responsible, and prevents costly disputes.

Benefits of Renters Insurance for Tenants and Landlords

For Tenants:

Covers personal belongings against fire, theft, or water damage.

Provides liability coverage in case someone is injured on the property.

Supports temporary living costs if the rental becomes uninhabitable.

For Landlords:

Reduces financial risk from tenant-caused damages.

Ensures tenants meet their legal responsibilities.

Simplifies lease enforcement and improves tenant relations.

How Richmond Helps Tenants Secure the Right Coverage

At Richmond Property Management, we know that understanding insurance can feel overwhelming. That’s why we guide tenants through finding reliable renters insurance in Windsor:

Lease Discussions: We include insurance requirements clearly in the lease.

Trusted Recommendations: We provide a list of local insurance providers to help tenants choose the right plan.

Ongoing Support: If tenants have questions about coverage, claims, or proof of insurance, our team is ready to assist.

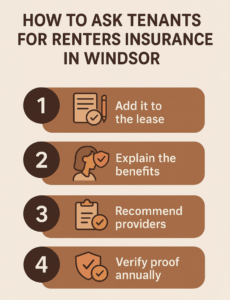

How to Bring Up Renters Insurance in Lease Discussions

Include in the Lease Agreement: Make coverage mandatory and outline minimum requirements.

Educate Tenants: Explain why insurance protects them and the property.

Provide Resources: Offer local providers or online tools to secure coverage quickly.

Check Proof of Insurance: Verify before move-in or lease renewal.

Common Misconceptions About Renters Insurance

“It’s too expensive.” Most policies are affordable and cost far less than replacing damaged items.

“The landlord’s insurance covers me.” Landlord insurance only protects the building — tenants’ personal property is not included.

“It’s optional.” Many landlords in Windsor legally require proof of coverage.

Requiring renters insurance in Windsor is a win-win: tenants gain protection and peace of mind, while landlords reduce risk and attract responsible renters. Richmond Property Management makes the process simple, offering guidance and resources so tenants can secure the right coverage with confidence.

“Have questions about renters insurance in Windsor? Contact Richmond Property Management today ; We’ll help you get covered and protect what matters most.”

Additional Resources: